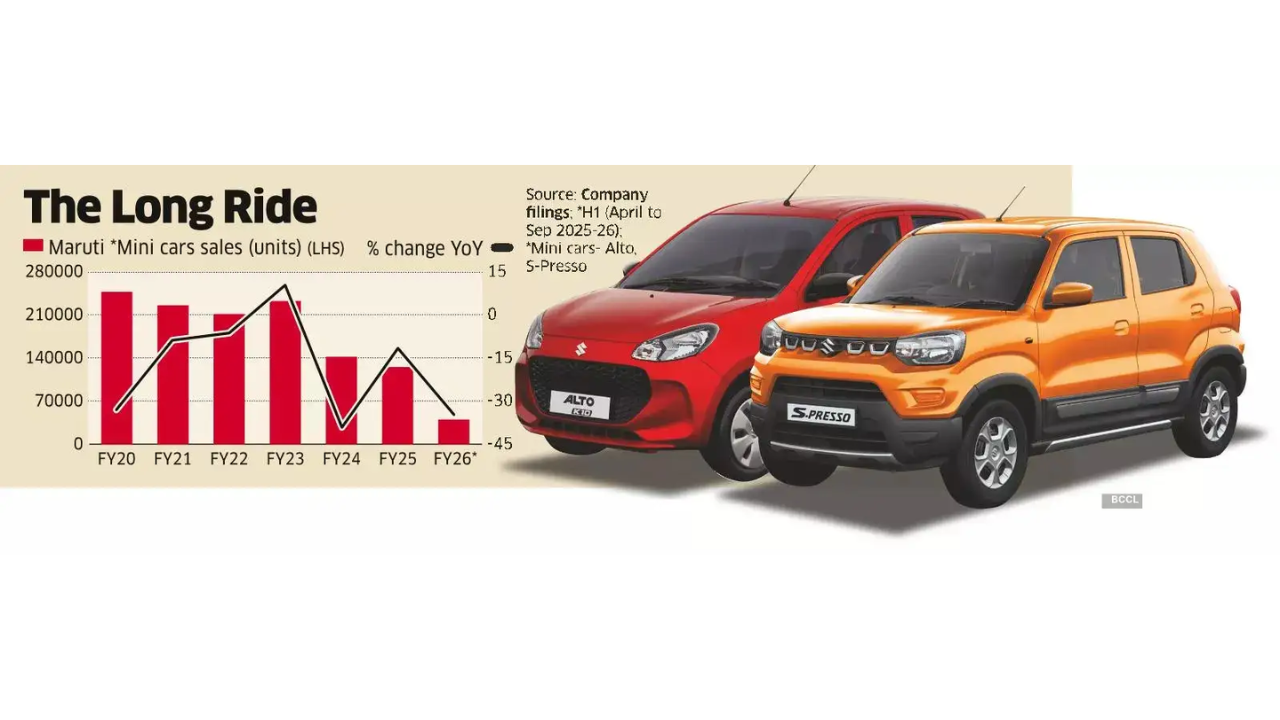

Maruti Suzuki India is intensifying efforts to boost sales of its entry-level cars, aiming to achieve record volumes for the Alto and S-Presso in the ongoing fiscal 2026. The company is relying on aggressive price reductions, festive finance schemes, and a focused push to attract two-wheeler riders into the four-wheeler segment.According to sources familiar with the matter told ET, Maruti has set a target to sell between 220,000 and 250,000 mini cars this fiscal year. The previous record for the segment was around 247,000 units in FY20.The renewed focus on small cars is part of Maruti’s broader strategy to arrest declining market share, which has been under pressure due to a slump in small-car sales alongside rising SUV demand. In FY25, the overall passenger vehicle market grew only 2% in cumulative wholesale dispatches, while Maruti’s market share fell to 40.9%, the lowest since FY13 when it stood at 39%. The company had commanded over 51% market share in FY19 and FY20.Maruti’s optimism is reinforced by a GST rate cut on small cars, which has effectively lowered prices by 11-13%. The company has also introduced a festive Rs 1,999 EMI scheme for entry-level models, launched during Navratri and extending through Diwali, to appeal to two-wheeler owners.

Dealers reported a surge in showroom footfalls and enquiries, particularly from rural and small-town buyers, though actual conversions remain limited. “The offer is very attractive and has brought new buyers into showrooms. We expect a major pickup during Dhanteras and Diwali,” said a Maruti dealer in western India.Partho Banerjee, Senior Executive Officer (Sales and Marketing) at Maruti Suzuki, said the entry-level segment is showing early signs of revival. “The response to the Rs 1,999 EMI offer has been very positive. Many two-wheeler customers who earlier did not consider buying a car are now visiting our showrooms. We are literally seeing helmets on discussion tables – that’s a very good indicator,” he told ET.Banerjee added that overall festive-period booking momentum has been strong. “Just to give you a perspective, the Alto bookings in October (till date) were up around 60% compared to the same month last year.” He noted that bookings for cars in the 18% GST bracket, including small cars, have risen sharply, though it is still early to quantify their full impact on overall sales.Industry observers, however, expressed caution over Maruti’s ambitious targets. “It’s a very tall target. Over the last five years, the car buyer has become a lot more aspirational. Even a first-time buyer is not keen on an entry-level model and prefers a second-hand premium hatchback like a Baleno,” said an industry executive, requesting anonymity.Analysts believe that while the push on affordability may come at the cost of average selling price and near-term margins – potentially around 100 basis points – it could expand market share and improve operating leverage if consumer response remains positive. Kapil Singh of Nomura Research noted that the initiative may strengthen Maruti’s base.According to Puneet Gupta, Director, S&P Global Mobility, the GST reduction could reignite demand in the mini-car segment. “Expect a wave of innovation in financing, product offerings, and ownership schemes aimed at reviving this category,” he said. With only 36 cars per 1,000 people, India’s vehicle ownership remains among the lowest globally, and this push could serve as a catalyst for two-wheeler users to transition to four-wheelers.Maruti has reduced prices across its lineup by 2-21%, with the steepest cuts on the Alto, S-Presso, and Celerio (13-22%). Larger models, including the Brezza, Grand Vitara, and Invicto, have seen reductions of 2-8%.Banerjee emphasised that Maruti is committed to maintaining a balanced presence across all segments. “As a market leader, we must have a play across all segments – hatchbacks, SUVs, MPVs, CNG, hybrids, and EVs. That’s what leadership means,” he said.