S&P Global, the US-based credit ratings agency, has upgraded India’s rating to ‘BBB’ from ‘BBB-) citing several positive factors in favour of the world’s fifth largest economy. S&P’s confidence in India’s growth story comes at a time when US President Donald Trump has imposed a 50% tariff on Indian exports to America, and has even called India a ‘dead economy’. This is reportedly the first rating upgrade for India in almost 19 years.The credit rating of an economy reflects the country’s ability and willingness to repay debt. It is a crucial indicator of economic health, indicating the risk level for investors and lenders. “The upgrade of India reflects its buoyant economic growth, against the backdrop of an enhanced monetary policy environment that anchors inflationary expectations. Together with the government’s commitment to fiscal consolidation and efforts to improve spending quality, we believe these factors have coalesced to benefit credit metrics,” S&P said.

Little impact of Trump’s tariffs on India

Not only has S&P upgraded India’s sovereign rating, it has also said that the impact of US tariffs is not likely to be extensive on India’s economy.“We believe the effect of US tariffs on the Indian economy will be manageable. India is relatively less reliant on trade and about 60% of its economic growth stems from domestic consumption,” S&P Global said.“We expect that in the event India has to switch from importing Russian crude oil, the fiscal cost, if fully borne by the government, will be modest given the narrow price differential between Russian crude and current international benchmarks,” it said.While the United States is India’s biggest trading ally, the potential imposition of 50% tariffs is not anticipated to significantly hinder economic growth. Exports from India to the US account for roughly 2% of the country’s GDP, S&P notes.Taking into account specific exemptions for sectors like pharmaceuticals and consumer electronics, the portion of Indian exports that would be affected by these tariffs decreases to 1.2% of GDP. Although this could lead to a temporary setback in growth, we predict that the overall effect will be minimal and will not disrupt India’s long-term economic trajectory, it added.Also Read | ’Secondary tariffs could go up…’: US official warns of higher sanctions on India if Trump’s talks with Putin fail; asks Europe to ‘put up or shut up’After Trump’s move to impose high tariffs on India, several global institutions and experts have predicted that India’s GDP growth may take an up to 0.3% hit due to US trade moves.

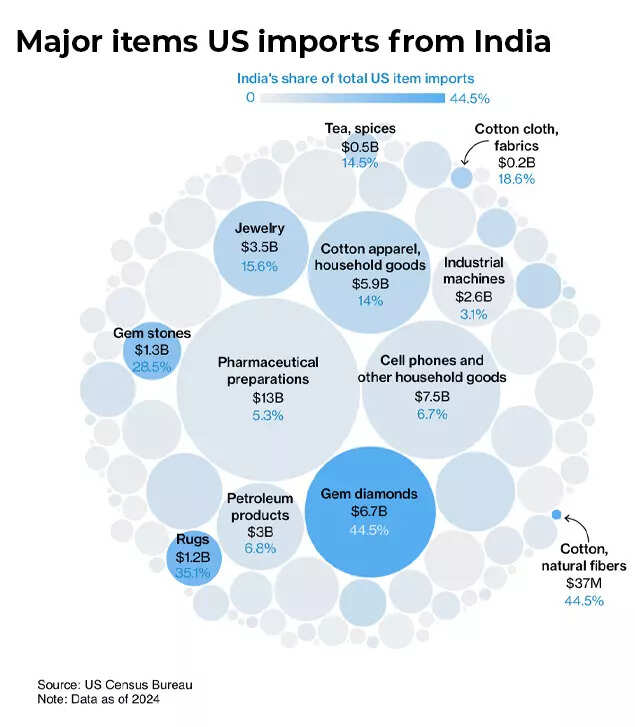

Major items US imports from India

Why did S&P upgrade India’s credit rating?

- India continues to be one of the top-performing economies globally. It has made a significant recovery from the pandemic, with real GDP growth from fiscal year 2022 (ending March 31) to fiscal year 2024 averaging 8.8%, the highest in the Asia-Pacific region.

- The Indian economy’s overall size is now believed to be approximately 80% bigger in rupee terms compared to its pre-COVID state, and nearly 50% larger when measured in dollars. However, the pace of economic growth is stabilizing towards a more sustainable rate, maintaining strong momentum.

- S&P anticipates that this growth trend will persist in the medium term, with GDP projected to rise by 6.8% annually over the next three years. This growth helps to moderate the government debt-to-GDP ratio, despite the presence of substantial fiscal deficits.

- The recent performance of India’s economy underscores its enduring strength. S&P’s forecasts for robust growth, despite external challenges, are based on the country’s positive structural developments. These include favorable demographics and competitive labor costs.

- India’s corporate and financial sectors have improved their balance sheets compared to the pre-pandemic period. Nonetheless, S&P acknowledges that maintaining high growth rates over an extended period is essential for the economy to generate enough jobs, lessen inequality, and fully capitalize on its demographic advantages.

- India’s fiscal weaknesses have historically been the most fragile aspect of its sovereign credit ratings. However, with the economy now on a solid recovery path, the government is able to outline a clearer, though gradual, strategy for fiscal consolidation. S&P forecasts suggest that the general government deficit, which is 7.3% of GDP in fiscal year 2026, will decrease to 6.6% by fiscal year 2029.

- Over the past five to six years, the quality of government expenditure has seen improvement, says S&P. The current government has increasingly prioritized infrastructure in its budget allocations. The union government’s capital expenditure is projected to rise to 11.2 trillion Indian rupees, or approximately 3.1% of GDP, by fiscal year 2026, up from 2% of GDP a decade ago.

- When including capital spending by state governments, total public investment in infrastructure is expected to be around 5.5% of GDP, which is comparable to or exceeds that of similar sovereign entities. S&P anticipate that enhancements in infrastructure and connectivity in India will eliminate bottlenecks that currently impede long-term economic growth.

- The shift in monetary policy towards inflation targeting has proven beneficial. Inflation expectations are now more stable compared to ten years ago. From 2008 to 2014, India frequently experienced inflation rates in the double digits. However, over the last three years, despite fluctuations in global energy prices and supply disruptions, the Consumer Price Index (CPI) has grown at an average rate of 5.5%. Recently, it has remained at the lower end of the Reserve Bank of India’s (RBI) target range of 2%-6%. These changes, along with a robust domestic capital market, indicate a more stable and conducive environment for monetary policy, says S&P.

- India’s sovereign ratings are supported by a vibrant and rapidly expanding economy, a strong external balance sheet, and democratic institutions that ensure policy consistency. These positive aspects are offset by the government’s poor fiscal performance, high debt levels, and low GDP per capita.

Indian Economy: The road ahead

“The Indian general elections resulted in a third consecutive term for Prime Minister Narendra Modi after his Bhartiya Janata Party (BJP) won the largest number of seats but fell short of an absolute majority. The subsequent formation of a coalition government is a first for the BJP, which has ruled independently in its previous two terms,”S&P said.“But the BJP retains a healthy majority in the Lok Sabha, India’s lower house of parliament. This supports the government’s efforts to implement economic reforms. Since the beginning of economic liberalization in 1991, India has had consistently high GDP growth while governed by different political parties and coalitions–reflecting a consensus on key economic policies,” it adds.Also Read | ‘Can’t cross some red lines’: Government officials tell Parliamentary Panel on India-US trade talks; focus on export diversification amidst Trump tariffs“In our view, the success of the government in funding large infrastructure investment without substantially widening the country’s current account deficit will be important. If India can shrink the fiscal deficit significantly while achieving these objectives, rating support will strengthen over time,” it says.According to S&P Global, its stable outlook indicates the belief that India’s long-term growth prospects will be bolstered by consistent policy stability and significant infrastructure investments. This, coupled with prudent fiscal and monetary policies that help manage the government’s high debt and interest obligations, will support the rating over the next two years.S&P said that it may upgrade the ratings if fiscal deficits significantly decrease, leading to a structural reduction in the net change of general government debt to below 6% of GDP. Sustained increases in public infrastructure investment would enhance economic growth, and when combined with fiscal reforms, could strengthen India’s weak public finances.However, S&P said it might consider lowering the ratings if it sees a decline in political commitment to improving public finances. Additionally, if India’s economic growth significantly slows down in a way that threatens fiscal sustainability, it could also exert downward pressure.